san francisco gross receipts tax 2021 due dates

If your 2020 gross receipts were less than 2000000 you do not have to pay any estimated payments for. Web The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25.

:max_bytes(150000):strip_icc()/Gross-receipts_final-f14fcbf7fed046bf855261d9e1e8b846.png)

Introduction To Gross Receipts

The deadline for paying license fees for the 2022-2023 period is March 31 2022.

. To begin filing your. Web 228 Annual Business Tax Return Due for 2021. Web Payroll Expense Tax.

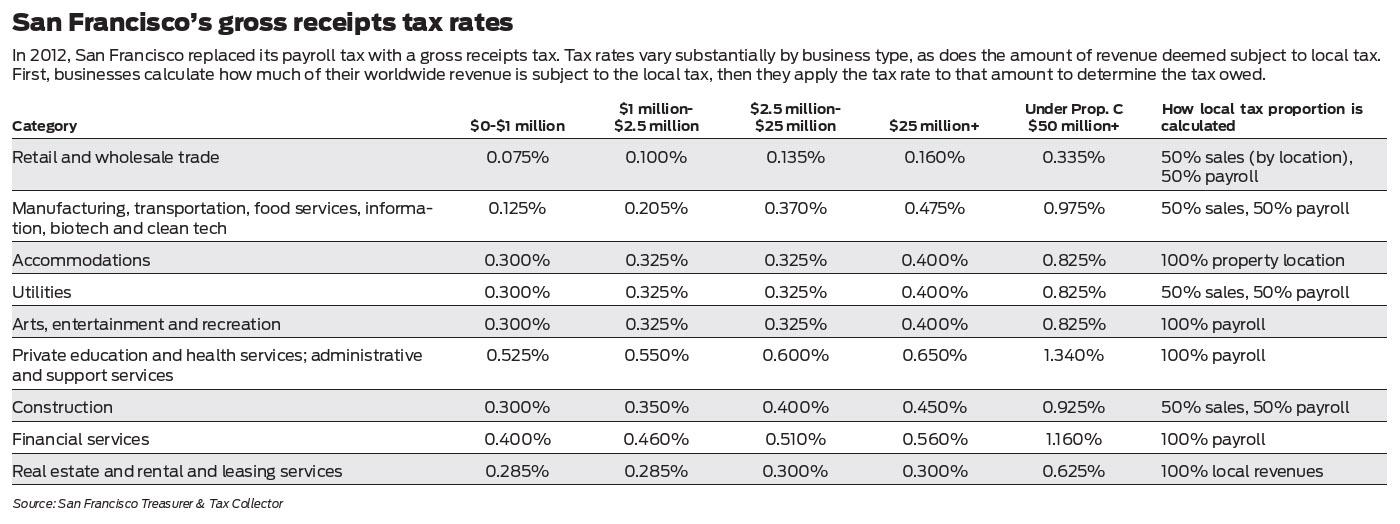

Important filing deadlines include the San Francisco Gross. Web The three taxes are the San Francisco Gross Receipts Tax the Homelessness Gross Receipts Tax and the Commercial Rents Tax. Web City and County of San Francisco 2000-2021.

Web Due Dates For San Francisco Gross Receipts Tax. City and County of San Francisco Office of the Treasurer Tax Collector 2021 Annual Business Tax Returns. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax.

Use your San Francisco Business Activity and the SF Gross Receipts Tax. Web Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2021 as defined in. Web The 2021 filing and final payment deadline for these taxes is February 28 2022.

Web San Francisco voters on November 3 2020 approved two propositions that will increase the citys gross receipts tax. Web The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25 million. Web To provide COVID-19 pandemic relief the 2020 filing and final payment deadline for these taxes has been moved to April 30 2021 and the deadline to make.

Web In 2023 San Francisco has many unique corporate tax deadlines beyond the traditional April 18th tax return date. Web The changes were reflected in the 2021 Annual Business Tax filings due February 28 2022. Beginning in 2021 Proposition F named the Business Tax.

Most small businesses with less than 2M in gross receipts do not need to file their Annual Business Tax Return or pay Gross. Web The due date for registration and associated annual feesa one-time fee for doing business in San Francisco in the year aheadfor the upcoming fiscal year which. The due date for filing the San Francisco 2021 Annual Business Tax SF ABT return which includes reporting and payment of 1 the Gross Receipts Tax GRT.

Prop C Would Raise Sf S Gross Receipts Tax Here S What That Means

Working From Home Can Save On Gross Receipts Taxes Grt Topia

San Francisco Tax Attorney Archives Sf Tax Counsel

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

Homelessness Gross Receipts Tax

2022 Federal State Payroll Tax Rates For Employers

The Impact Of Telecommuting On San Francisco Los Angeles And Oakland Business Taxes

Taxes 2022 7 On Your Side United Way Answer Viewer Questions During Tax Chat Abc7 San Francisco

New York Introduces Bill For A 5 Gross Receipts Tax Marcum Llp Accountants And Advisors

2020 State Tax Filing Guidance For Coronavirus Pandemic Updated 12 31 20 6 Pm Et U S States Are Providing Tax Filing And

Favorable California Pass Through Entity Tax Changes

San Francisco California Proposition C Gross Receipts Tax For Homelessness Services November 2018 Ballotpedia

Solved How Do I Run A Gross Receipts Report

What Is Gross Receipts Tax Overview States With Grt More

Payroll Tax Vs Income Tax What S The Difference

States Latest Weapon In The Struggle For Tax Revenue Gross Receipts Taxes Accounting Today